2. 15+ Finance Career Paths: Essential Fordham Ms Finance Insights

Unlocking Your Financial Future: Exploring Diverse Career Paths with Fordham’s MS in Finance Program

The field of finance offers a plethora of exciting career opportunities, and with the right education and skills, you can embark on a rewarding journey. In this comprehensive guide, we will delve into the diverse career paths available to graduates of Fordham’s MS in Finance program, providing you with valuable insights to navigate your financial career.

The Power of a Fordham MS in Finance

Fordham University’s Master of Science in Finance program is renowned for its rigorous curriculum and industry-relevant approach. This prestigious program equips students with the knowledge and skills needed to excel in various financial domains. By combining theoretical concepts with practical applications, Fordham prepares its graduates to make an impact in the dynamic world of finance.

15+ Career Paths to Explore

1. Investment Banking

Description: Investment bankers play a crucial role in facilitating mergers and acquisitions, raising capital, and providing financial advisory services to corporations and governments. They are involved in deal structuring, valuation, and negotiating terms.

Skills Required: Strong analytical abilities, financial modeling expertise, and excellent communication skills are essential. Investment bankers must navigate complex financial landscapes and communicate effectively with clients.

2. Financial Planning and Analysis (FP&A)

Description: FP&A professionals are responsible for budgeting, forecasting, and analyzing financial data to support strategic decision-making within organizations. They provide insights to improve financial performance and drive business growth.

Skills Required: A solid understanding of accounting principles, data analysis skills, and proficiency in financial software are key. FP&A analysts must interpret financial data and present findings to stakeholders.

3. Corporate Finance

Description: Corporate finance professionals focus on optimizing a company’s financial health. They manage cash flow, financial planning, and investment decisions to ensure long-term financial stability and growth.

Skills Required: Financial analysis, strategic thinking, and risk management abilities are crucial. Corporate finance experts must make informed decisions to maximize shareholder value.

4. Commercial Banking

Description: Commercial bankers work with businesses to provide financial services such as loans, deposits, and cash management solutions. They assess credit risk and offer tailored financial products to meet business needs.

Skills Required: Strong credit analysis skills, knowledge of banking regulations, and relationship-building abilities are essential. Commercial bankers must understand client requirements and provide customized solutions.

5. Wealth Management

Description: Wealth managers assist high-net-worth individuals and families in managing their financial portfolios. They provide investment advice, tax planning, and estate planning services to help clients achieve their financial goals.

Skills Required: Financial planning expertise, knowledge of investment strategies, and excellent client relationship skills are vital. Wealth managers must build trust and offer tailored financial solutions.

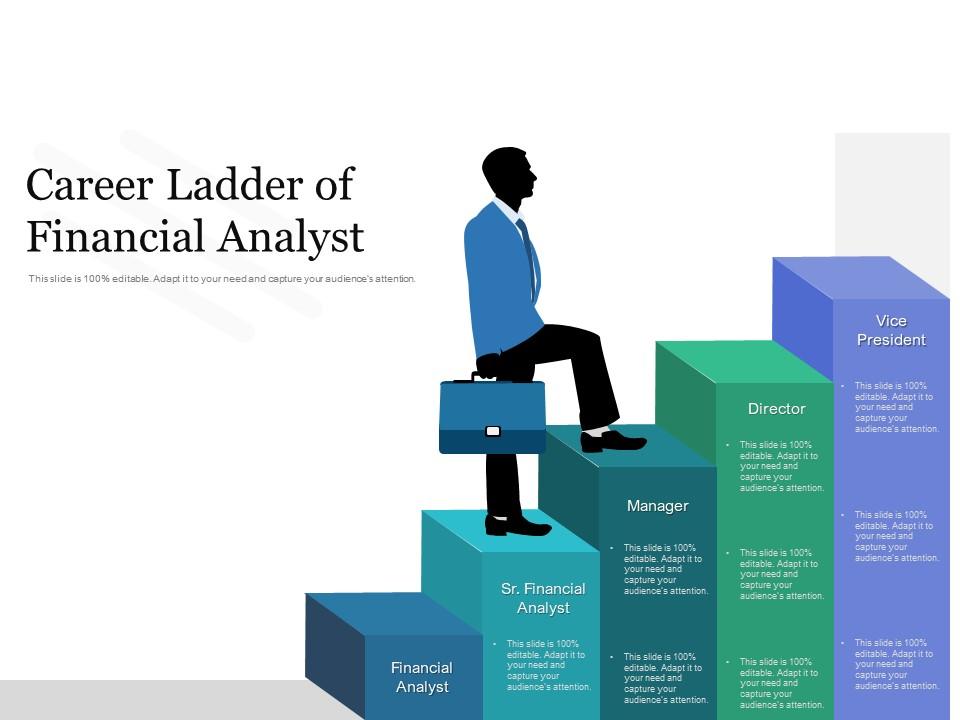

6. Financial Analysis and Research

Description: Financial analysts and researchers analyze market trends, company performance, and economic data to provide insights and recommendations to investors and businesses. They conduct in-depth research and prepare reports.

Skills Required: Proficiency in data analysis, strong research skills, and the ability to interpret complex financial information are key. Financial analysts must communicate their findings clearly and provide actionable recommendations.

7. Private Equity

Description: Private equity professionals invest in private companies with the aim of improving their financial performance and reselling them at a higher value. They conduct due diligence, negotiate deals, and manage portfolio companies.

Skills Required: Financial modeling, valuation, and deal-making expertise are essential. Private equity professionals must identify investment opportunities and drive value creation.

8. Venture Capital

Description: Venture capitalists invest in early-stage companies with high growth potential. They provide funding, strategic guidance, and mentorship to help startups succeed.

Skills Required: A deep understanding of the startup ecosystem, deal sourcing skills, and the ability to assess risk are crucial. Venture capitalists must identify promising startups and support their growth.

9. Hedge Funds

Description: Hedge fund managers employ various investment strategies to generate high returns for their investors. They manage complex portfolios and use advanced financial techniques.

Skills Required: Expertise in financial markets, risk management, and portfolio optimization is vital. Hedge fund managers must make informed investment decisions and manage risks effectively.

10. Asset Management

Description: Asset managers oversee investment portfolios on behalf of individuals, institutions, and pension funds. They select and manage investments to meet specific financial goals.

Skills Required: Strong investment knowledge, portfolio management skills, and an understanding of regulatory frameworks are essential. Asset managers must make strategic investment decisions and monitor portfolio performance.

11. Risk Management

Description: Risk managers identify, assess, and mitigate financial risks within organizations. They develop risk management strategies, implement controls, and ensure compliance with regulations.

Skills Required: A thorough understanding of risk analysis, regulatory requirements, and financial modeling is crucial. Risk managers must identify potential risks and implement effective risk mitigation measures.

12. Insurance

Description: Insurance professionals work in various roles, including underwriting, actuarial analysis, and claims management. They assess risk, price insurance policies, and manage insurance portfolios.

Skills Required: Knowledge of insurance products, risk assessment techniques, and statistical analysis are key. Insurance professionals must understand client needs and provide appropriate coverage.

13. Financial Technology (Fintech)

Description: Fintech professionals work at the intersection of finance and technology, developing innovative solutions to enhance financial services. They focus on areas like digital payments, blockchain, and artificial intelligence.

Skills Required: A combination of financial expertise and technological skills is essential. Fintech professionals must stay updated with the latest technologies and drive digital transformation in the financial industry.

14. Corporate Development

Description: Corporate development professionals are involved in strategic planning, mergers and acquisitions, and business development. They identify growth opportunities, conduct due diligence, and negotiate deals.

Skills Required: Strategic thinking, deal-making expertise, and strong business acumen are vital. Corporate development professionals must align business strategies with financial goals.

15. Treasury Management

Description: Treasury managers oversee an organization’s financial assets and liabilities. They manage cash flow, investment decisions, and risk mitigation strategies to optimize financial performance.

Skills Required: Financial analysis, cash management skills, and a deep understanding of financial markets are crucial. Treasury managers must make informed decisions to maximize financial returns.

16. Personal Finance

Description: Personal finance professionals guide individuals in managing their finances, including budgeting, investing, and retirement planning. They provide personalized financial advice and education.

Skills Required: Knowledge of personal finance principles, investment strategies, and tax planning is essential. Personal finance experts must build trust and empower individuals to achieve their financial goals.

Choosing Your Path

When considering your career path, it’s important to align your interests, skills, and values with the specific roles in the finance industry. Here are some factors to consider:

Passion: Identify the areas of finance that resonate with your passions and interests. Whether it’s investment strategies, corporate finance, or financial technology, finding your niche can lead to a fulfilling career.

Skills and Strengths: Evaluate your strengths and the skills you excel in. Do you have a knack for data analysis, financial modeling, or relationship building? Choose a career path that allows you to leverage your unique abilities.

Industry Trends: Stay updated with the latest trends and developments in the finance industry. Understanding emerging opportunities and challenges can help you make informed career choices.

Networking: Build a strong professional network by attending industry events, joining finance-related clubs, and connecting with alumni. Networking can provide valuable insights and open doors to new opportunities.

Notes:

-

🌟 Note: The career paths outlined above are just a glimpse of the diverse opportunities available. Explore further to discover more specialized roles within the finance industry.

-

💡 Note: Fordham's MS in Finance program offers specialized courses and electives to enhance your skills and knowledge in specific areas of finance. Utilize these opportunities to tailor your education to your career goals.

-

🌐 Note: Stay connected with alumni and industry professionals through online platforms and social media. These connections can provide mentorship, job opportunities, and valuable insights into the finance industry.

Conclusion

Fordham’s MS in Finance program opens doors to a wide range of exciting career paths in the financial world. From investment banking to wealth management and fintech, the possibilities are vast. By understanding your passions, skills, and the evolving landscape of finance, you can embark on a rewarding journey, making a significant impact in the industry.

FAQ

What are the key skills needed to succeed in a finance career?

+

Key skills include analytical thinking, financial modeling, data analysis, communication, and a strong understanding of financial markets and regulations.

How can I gain practical experience during my MS in Finance program?

+

Look for internship opportunities, participate in case competitions, and engage in industry projects to apply your knowledge and build real-world experience.

What are some common challenges faced in the finance industry?

+

Challenges may include keeping up with regulatory changes, managing risk effectively, and adapting to rapidly evolving technologies and market trends.

How can I stay updated with industry trends and developments?

+

Follow reputable finance publications, attend industry conferences and webinars, and connect with professionals in your network to stay informed about the latest trends.

What are the growth prospects in the finance industry?

+The finance industry offers excellent growth opportunities, with increasing demand for skilled professionals in areas like fintech, wealth management, and risk management.